DOI:

https://doi.org/10.64539/msts.v1i2.2025.336Keywords:

FinTech, Financial Sustainability, Digital Transformation, Emerging Economies, Institutional Readiness, Financial Inclusion, Sustainable Finance, Governance, Panel Data Analysis, Cross-Regional ComparisonAbstract

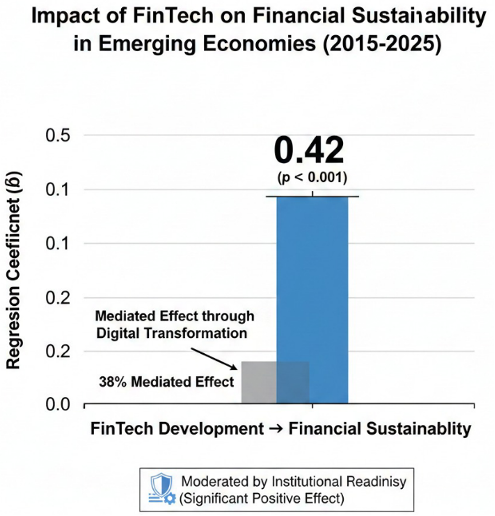

Financial Technology (FinTech) has been a revolutionary force in the last ten years, especially in emerging economies that are working to expedite digital transformation and attain financial sustainability. This study examines how FinTech development affects financial sustainability, using institutional preparedness as a moderating variable and digital transformation as a mediating factor. The study uses fixed-effects panel regression analysis to investigate cross-regional dynamics using a panel dataset of 18 rising economies in Africa, the Middle East, and Southeast Asia from 2015 to 2025. FinTech development considerably improves financial sustainability, according to empirical studies (β = 0.42, p < 0.001), with digital transformation processes mediating about 38% of this benefit. This association is further strengthened by institutional preparedness, suggesting that regulatory frameworks and governance quality are crucial for maintaining FinTech-driven growth. Southeast Asia has the strongest correlation between FinTech adoption and sustainability, according to regional studies, whereas Sub-Saharan Africa's influence is still limited by policy and infrastructure constraints. The results highlight how FinTech may promote equitable and sustainable financial systems when it is backed by strong digital governance. It is recommended that policymakers advance financial literacy, improve digital infrastructure, and include ESG principles into FinTech regulations. This study advances our theoretical and practical knowledge of how FinTech may promote digital inclusion, economic resilience, and sustainable financial growth in developing nations.

References

[1] D. W. Arner, R. P. Buckley, and D. A. Zetzsche, “Fintech for Financial Inclusion: A Framework for Digital Financial Transformation,” SSRN Electronic Journal, 2018, https://doi.org/10.2139/ssrn.3245287.

[2] I. Lee and Y. J. Shin, “Fintech: Ecosystem, business models, investment decisions, and challenges,” Bus Horiz, vol. 61, no. 1, pp. 35–46, Jan. 2018, https://doi.org/10.1016/j.bushor.2017.09.003.

[3] D. Mhlanga, FinTech, Financial Inclusion, and Sustainable Development. London: Routledge, 2024. https://doi.org/10.4324/9781032657981.

[4] I. Mavlutova, A. Spilbergs, A. Verdenhofs, A. Natrins, I. Arefjevs, and T. Volkova, “Digital Transformation as a Driver of the Financial Sector Sustainable Development: An Impact on Financial Inclusion and Operational Efficiency,” Sustainability, vol. 15, no. 1, p. 207, Dec. 2022, https://doi.org/10.3390/su15010207.

[5] G. Vial, “Understanding digital transformation: A review and a research agenda,” The Journal of Strategic Information Systems, vol. 28, no. 2, pp. 118–144, Jun. 2019, https://doi.org/10.1016/j.jsis.2019.01.003.

[6] C. Clivaz, “Digitized and Digitalized Humanities: Words and Identity,” Atti del IX Convegno Annuale AIUCD. La svolta inevitabile: sfide e prospettive per l’Informatica Umanistica, pp. 67–73, 2020, https://doi.org/10.6092/unibo/amsacta/6316.

[7] World Bank, “Global Findex Database,” World Bank Group. [Online]. Available: https://databank.worldbank.org/source/global-findex-database.

[8] K. Donovan, “Mobile Money for Financial Inclusion,” Information and Communications for Development, pp. 61–73, 2012, [Online]. Available: https://open.uct.ac.za/items/33bf6439-b32c-47d7-8f04-cb916e162134.

[9] T. Suri and W. Jack, “The long-run poverty and gender impacts of mobile money,” Science (1979), vol. 354, no. 6317, pp. 1288–1292, Dec. 2016, https://doi.org/10.1126/science.aah5309.

[10] OECD, “Directorate for Public Governance,” Organisation for Economic Co-operation and Development. [Online]. Available: https://www.oecd.org/gov/govataglance/.

[11] S. Kraus, C. Palmer, N. Kailer, F. L. Kallinger, and J. Spitzer, “Digital entrepreneurship,” International Journal of Entrepreneurial Behavior & Research, vol. ahead-of-print, no. ahead-of-print, Sep. 2018, https://doi.org/10.1108/IJEBR-06-2018-0425.

[12] A. Y. Mamun and V. László, “Advancing sustainability through financial inclusion and sustainable finance: a systematic literature review,” Digit Finance, vol. 7, no. 4, pp. 853–870, Dec. 2025, https://doi.org/10.1007/s42521-025-00142-7.

[13] A. Sergeev, D. W. Arner, and K. Charamba, “Policymakers, BigFintechs and the United Nations Sustainable Development Goals,” SSRN Electronic Journal, 2021, https://doi.org/10.2139/ssrn.3870612.

[14] J. K. Roy and L. Vasa, “Financial technology and environmental, social and governance in sustainable finance: a bibliometric and thematic content analysis,” Discover Sustainability, vol. 6, no. 1, p. 148, Mar. 2025, https://doi.org/10.1007/s43621-025-00934-2.

[15] V. Sharma and B. Priya, “Bridging the gap: AI-powered FinTech and its impact on financial inclusion and financial well-being,” Discover Artificial Intelligence, vol. 5, no. 1, p. 290, Oct. 2025, https://doi.org/10.1007/s44163-025-00465-9.

[16] D. A. Zetzsche, R. P. Buckley, and D. W. Arner, “FinTech for Financial Inclusion,” in Sustainable Development Goals, Wiley, 2019, pp. 177–203. https://doi.org/10.1002/9781119541851.ch10.

[17] G. Zairis, P. Liargovas, and N. Apostolopoulos, “Sustainable Finance and ESG Importance: A Systematic Literature Review and Research Agenda,” Sustainability, vol. 16, no. 7, p. 2878, Mar. 2024, https://doi.org/10.3390/su16072878.

[18] A. W. F. Kouam, “Steering the digital shift: the role of fintech in transforming banking in emerging markets,” SN Business & Economics, vol. 5, no. 10, p. 135, Sep. 2025, https://doi.org/10.1007/s43546-025-00912-w.

[19] T. Puschmann and S. Shiba, “Sustainable Digital Finance: Developing a Taxonomy for FinTech, InsurTech, and Blockchain,” Swiss FinTech Innovation Lab, 2021, [Online]. Available: https://www.zora.uzh.ch/entities/publication/99a3e437-65d7-4259-b1ee-91e2560bb5f9.

[20] O. Akanfe, P. Bhatt, and D. A. Lawong, “Technology Advancements Shaping the Financial Inclusion Landscape: Present Interventions, Emergence of Artificial Intelligence and Future Directions,” Information Systems Frontiers, vol. 27, no. 5, pp. 2189–2212, Oct. 2025, https://doi.org/10.1007/s10796-025-10597-z.

[21] Y. Mo, Y. Che, and W. Ning, “Digital Finance Promotes Corporate ESG Performance: Evidence from China,” Sustainability, vol. 15, no. 14, p. 11323, Jul. 2023, https://doi.org/10.3390/su151411323.

[22] UNCTAD, “Technology and Innovation Report 2023: Opening Green Windows—Technological Opportunities for a Low-Carbon World,” UN Trade and Development. [Online]. Available: https://unctad.org/tir2023.

[23] S. ur Rehman, A. R. Gill, and M. Ali, “Information and communication technology, institutional quality, and environmental sustainability in ASEAN countries,” Environmental Science and Pollution Research, Apr. 2023, https://doi.org/10.1007/s11356-023-27219-3.

[24] I. Koomson, R. A. Villano, and D. Hadley, “The role of financial literacy in households’ asset accumulation process: evidence from Ghana,” Rev Econ Househ, vol. 21, no. 2, pp. 591–614, Jun. 2023, https://doi.org/10.1007/s11150-022-09603-z.

[25] W. Jack and T. Suri, “Risk Sharing and Transactions Costs: Evidence from Kenya’s Mobile Money Revolution,” American Economic Review, vol. 104, no. 1, pp. 183–223, Jan. 2014, https://doi.org/10.1257/aer.104.1.183.

[26] N. Hughes and S. Lonie, “M-PESA: Mobile Money for the ‘Unbanked’ Turning Cellphones into 24-Hour Tellers in Kenya,” Innovations: Technology, Governance, Globalization, vol. 2, no. 1–2, pp. 63–81, Apr. 2007, https://doi.org/10.1162/itgg.2007.2.1-2.63.

[27] OECD, “Competition, Fintechs and Open Banking: An overview of recent developments in Latin America and the Caribbean,” OECD, 2024, https://doi.org/10.1787/20758677.

[28] C. Ede, “The Intersection of Cryptocurrencies With Fiat Currency Financial System in Nigeria: Examining the Rationality of CBN’s Restrictive Approach and Changes Made by the 2023 CBN Guidelines on the Operation of Bank Accounts by Vasps,” SSRN Electronic Journal, Feb. 2024, https://doi.org/10.2139/ssrn.4722632.

[29] World Bank, “Fintech and Financial Inclusion in ASEAN.” Washington, DC, USA, 2020.

[30] A. Ghosh and A. Bhatia, “Bridging the Digital Divide,” in Financial Innovation for Global Sustainability, Wiley, 2025, pp. 305–336. https://doi.org/10.1002/9781394311682.ch13.

[31] K. Ariansyah et al., “The role of mobile broadband in poverty alleviation: a comparison of the effects of 3G and 4G network expansion in underdeveloped regions of Indonesia,” Inf Technol Dev, vol. 31, no. 1, pp. 206–231, Jan. 2025, https://doi.org/10.1080/02681102.2024.2361482.

[32] H. Wang, Driving Financial Inclusion Through Central Bank Digital Currencies: A Methodology for CBDC Implementation. UNDP Global Centre for Technology, Innovation and Sustainable Development, 2025. Accessed: Dec. 01, 2025. [Online]. Available: https://www.undp.org/sites/g/files/zskgke326/files/2025-06/undp-driving-financial-inclusion-through-cbdcs.pdf.

[33] M. Ahmed, A. Khaskheli, S. A. Raza, and M. K. Hassan, “Eco-tech fusion: Unraveling the nonparametric causal effects of fintech, natural resources, digital infrastructure, and economic growth on environmental sustainability from a quantile perspective,” Resources Policy, vol. 98, p. 105324, Nov. 2024, https://doi.org/10.1016/j.resourpol.2024.105324.

[34] L. G. Tornatzky, M. Fleischer, and A. K. Chakrabarti, The processes of technological innovation. Lexington Books, 1990. [Online]. Available: https://cir.nii.ac.jp/crid/1971712334809816714.

[35] B. Wernerfelt, “A resource‐based view of the firm,” Strategic Management Journal, vol. 5, no. 2, pp. 171–180, Apr. 1984, https://doi.org/10.1002/smj.4250050207.